A Letter from the Broker:

Time really does fly. Summer is in full swing, and the turn season is upon us. Despite the headwinds in the interest rate environment, student housing operations remain strong relative to rent growth and leasing. Borrowing costs have slowed down the development and acquisitions in the marketplace, which gives owners the opportunity to truly drill down and focus on their own assets to ensure operations remain on an efficient and positive path. While velocity picked up into Q2, it is still much slower than hoped. We expect that to change by Q4 with the built-up demand to start deploying capital again. There have been many new investors both entering and hovering around this asset class, growing fond of the somewhat predictable operations that have been on a constant upward trajectory. Deals are getting done, albeit fewer of them, and they are taking much longer to transact. The quote on the cover of Student Housing Business’s latest issue said it best, “Stymied by higher interest rates, sponsors and lenders are getting deals done by working together.” Being transactional in an efficient market is easy, but a committed buyer and seller are necessary to get deals across the finish line in a market with turbulence. These types of markets are where many buyers, sellers, brokers, lenders and ancillary businesses can truly make their mark. Word travels fast within this asset class. Stay the course and hunker down; the not-so-distant future is bright.

Patrick Mullowney

Campus Investment Properties

(513) 878-7754

Joel Dumes

Senior Managing Director

(513)-878-7720

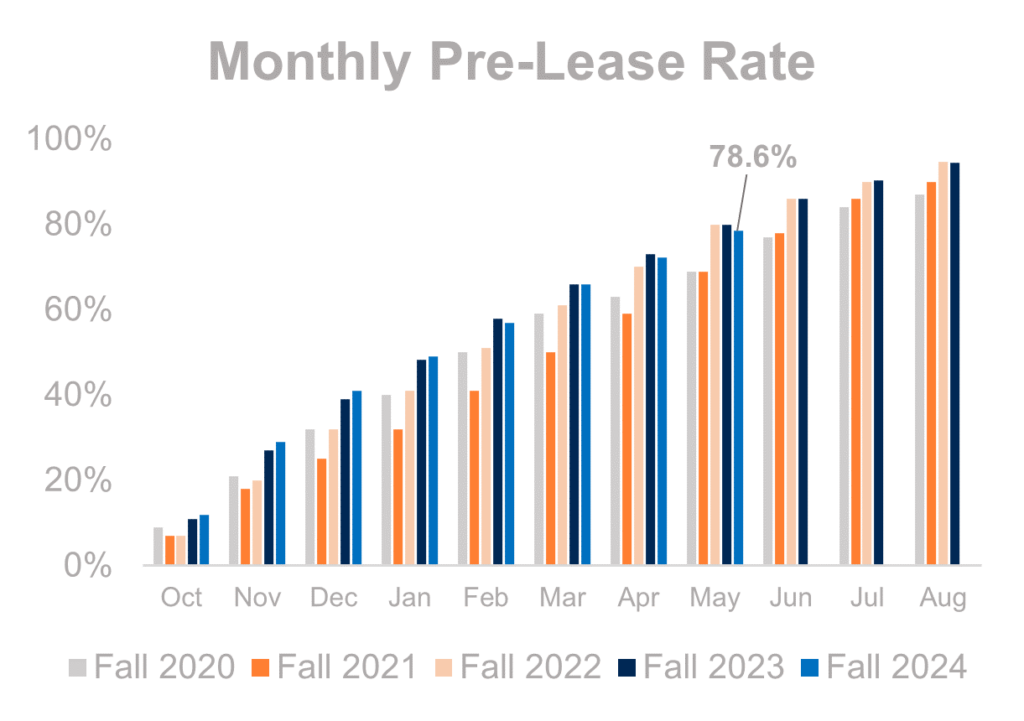

Is the Pre-Lease Rate YoY Drop Concerning?

As of May, 78.6% of beds are pre-leased for fall 2024 at the core 175 universities tracked by RealPage1. As of July 1st, College House reports a pre-lease occupancy of 82% for fall 2024; 27 markets are 95% pre-leased or more3. The summer months, when students are not living on campus, are expected to see an approximate 5% jump in pre-lease momentum month-over-month1.

Pre-lease rates have fallen slightly below the past two years’ rates for a few reasons. Post-covid, pre-lease rates and rent growth have been exceptionally high. These rates cannot just keep rising; we likely saw the peak last pre-leasing cycle. At some point, pre-lease rates and rent growth must settle into a more predictable, steady pace, and this pre-leasing cycle saw the beginning of this. Rates are slowing down and settling at a steadier pace but are still well above pre-covid rates.

Rent Growth Remains High

According to College House, average rent per bed was $964 as of July 1st. According to Yardi Matrix, which tracks different properties than College House, the average rent per bed was $897 in May[3]. This is a new high and is 5.3% above last May’s average rent per bed. Schools with strong pre-leasing activity consistently see the strongest rent growth. The University of Tennessee continued to be the market with the highest rent growth at 25% year-over-year. About 10 other campuses saw rent growth over 10%, including Ole Miss, University of Kentucky, Purdue, College of Charleston, and University of Arizona1.

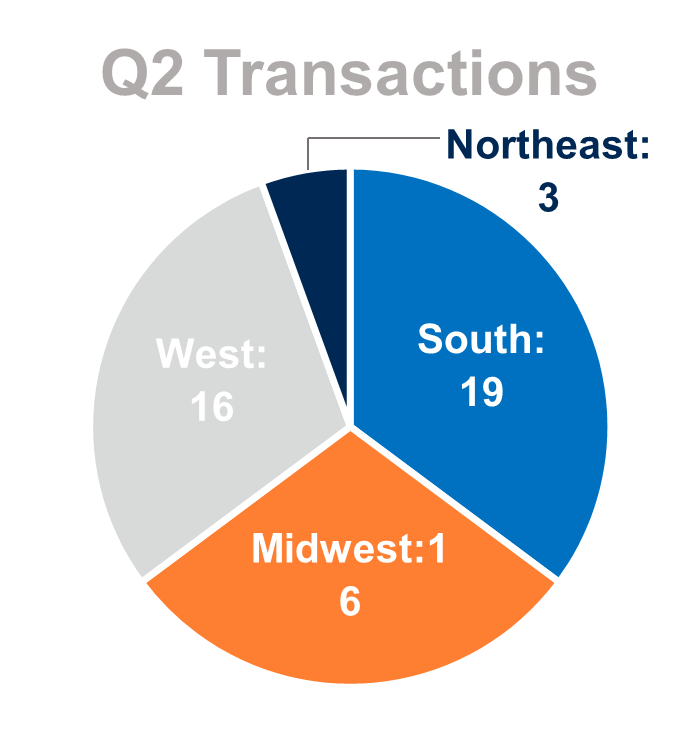

Recent Transactions and Development Pipeline

In the second quarter of 2024, there were 54 student housing transactions with 6,581 units and 19,785 beds. Texas saw the most properties trade hands, with eight transactions (1,007 units with 3,097 beds). The universities that saw the most units transact were the University of Mississippi (2 transactions with 484 units and 1,450 beds), the University of Wisconsin – Madison (1 transaction with 465 units and 1,645 beds), and North Carolina State University (1 transaction with 420 units and 740 beds).

Tallahassee, Florida, Madison, Wisconsin, and Knoxville, Tennessee are the top three markets with the highest development pipelines overall2. Approximately 40,000 beds are currently under construction and over 60,000 beds are in the planning stage, according to College House. The Southeast has the most beds under construction and in the planning stage with 13,983 beds and 23,825 beds respectively. Yardi Matrix predicts 45,495 beds will come online this year, which is nearly 8,000 more beds than 2023. Again, Yardi Matrix tracks different markets than College House, which accounts for the slight difference in numbers. The University of Wisconsin-Madison, Florida International, the University of Texas-Austin, ASU-Downtown and UC-Davis are among the markets with the largest incoming pipelines this year, all exceeding 2,000 beds3.

How FAFSA Impacted Student Housing Statistics

Another major reason for the pre-leasing slowdown is the government’s overhaul of the FAFSA, or the Free Application for Federal Student Aid. This redesign caused the FAFSA to be released three months later than usual, which impacted both universities and students applying to college. For many students, the amount of financial aid a school awards them is the determining factor for which university they choose to attend. This also delays universities’ ability to award financial aid of their own. Without knowing how much aid the government is giving a student, universities cannot offer their own aid. This will likely cause more expensive, private universities to see decreased enrollment. On the other hand, public universities and community colleges will likely benefit from this, as many students were forced to decide which school they will attend before receiving financial aid.

Looking Ahead

Pre-lease and rent growth rates remain consistent, as usual. Even with the FAFSA debacle, these numbers show how steady the student housing industry is. There was some wavering of the pre-lease rate, which was expected, but it still held its own against rates from the past few years. Slowly but surely, velocity is picking up. By Q4, built-up demand will cause buyers to start deploying capital again. It is important that buyers, sellers, brokers, and lenders work together to get deals across the finish line. This is the market we have been waiting for. It isn’t quite here yet, but it will be soon.

[1] RealPage Analytics: Still Historically Strong, Student Housing Pre-Leasing and Rent Growth Fall Below Year-Ago Records

[2] College House Market Performance and Industry Key Metrics

[3] Multi-Housing News: National Student Housing Report – June 2024